Swap rates provide businesses and investors with crucial benchmarks for interest rate swaps, helping manage risk, hedge exposure, and optimize financing strategies in the financial markets.

| Current | 1 Day Ago | 1 Month Ago | 1 Year Ago | |

|---|---|---|---|---|

| SOFR | ||||

| 1 Month Term | 5.3288% | 5.3287% | 5.3308% | 5.1964% |

| US Treasuries | ||||

| 5 Year | 4.120% | 4.122% | 4.235% | 3.935% |

| 7 Year | 4.135% | 4.138% | 4.227% | 3.856% |

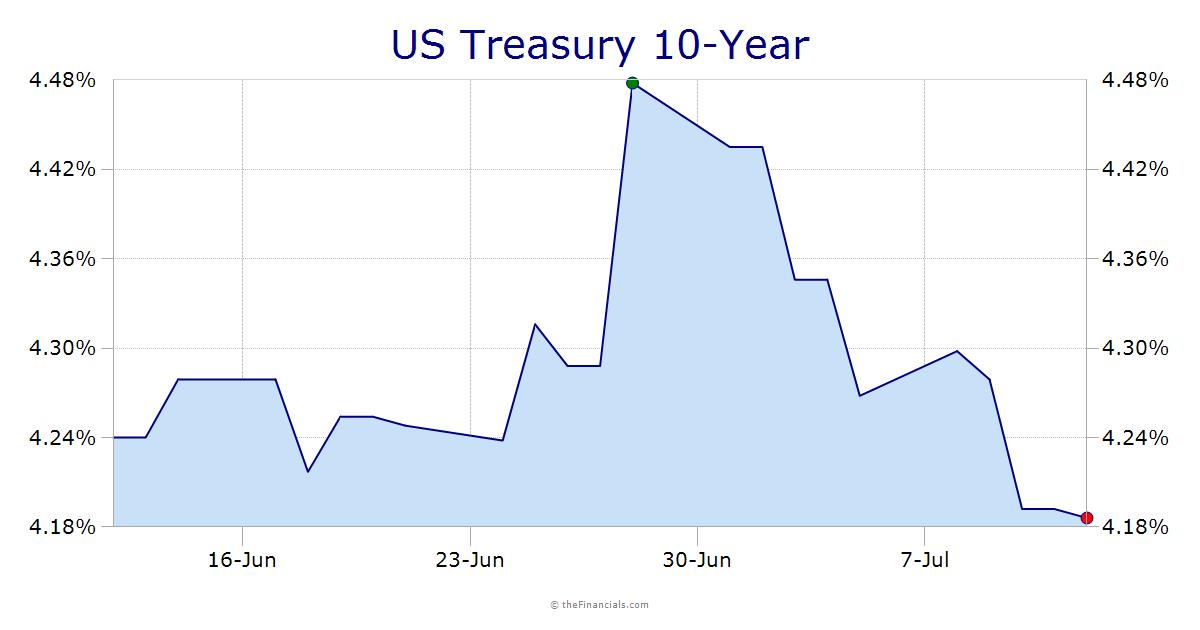

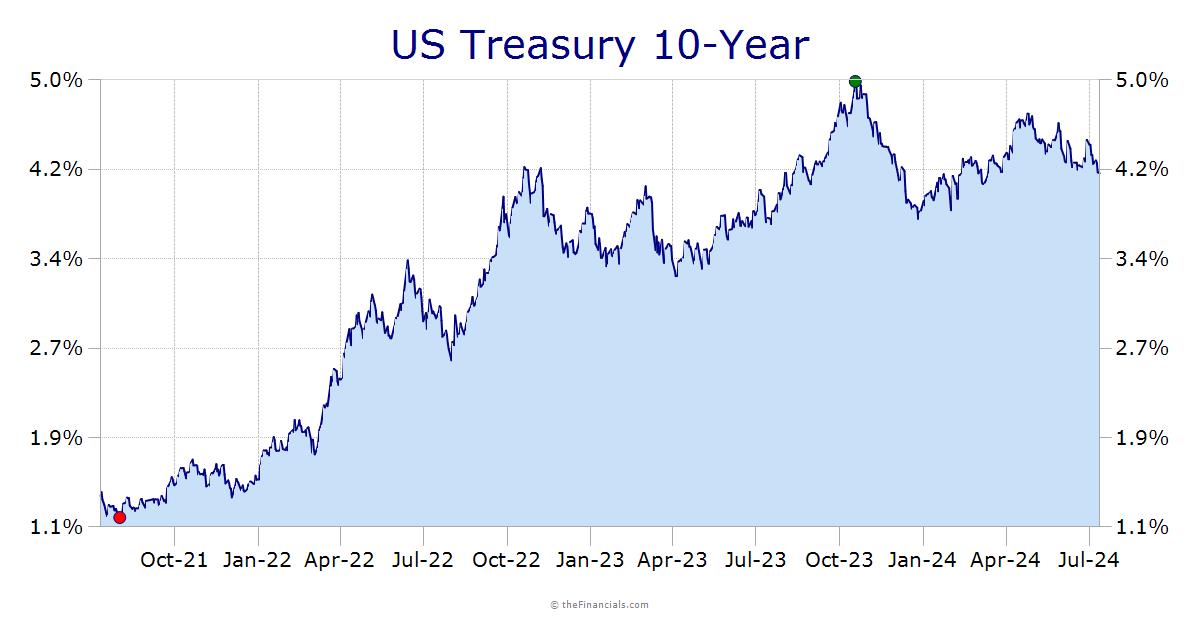

| 10 Year | 4.196% | 4.192% | 4.240% | 3.759% |

When pricing commercial real estate (CRE) loans, lenders typically reference index rates to determine your loan’s interest rate. In 2026, the Secured Overnight Financing Rate (SOFR) has largely replaced LIBOR as the primary benchmark. LIBOR is now only used as historical reference for legacy floating-rate loans.

The most common index rates for CRE loan pricing today include:

SOFR (1-month, 3-month, and term SOFR rates) — primary benchmark

Swap rates (5-, 7-, 10-year) — used for fixed-rate pricing

Treasury yields (5-, 7-, 10-year) — less common, sometimes used for pricing

LIBOR (1-month, 3-month) — historical context only, mainly for legacy floating-rate loans

Last Updated: January 2026

Data Source: Federal Reserve Bank, ICE Benchmark Administration

Commercial loans are typically quoted as a spread over an index rate. Here’s how it works:

Example 1 – 10-year fixed rate:

If the loan spread is 200 bps (2.00%) over the 10-year swap rate, you add 2.00% to the 10-year swap rate to get your current coupon.

Example 2 – 7-year fixed rate:

With a 175 bps (1.75%) spread over the 7-year swap, the loan rate = 7-year swap + 1.75%.

Example 3 – Floating bridge loan:

Historically, a bridge loan might have been quoted 350 bps (3.50%) over 1-month LIBOR. Today, it would likely be SOFR + spread, and you may use an interest rate cap to manage rate fluctuations.

Key Notes:

Swap rates are now the primary benchmark for fixed-rate CRE loans: CMBS, Fannie Mae, Freddie Mac, life insurance loans, and many bank loans.

Treasury-based pricing is less common but still used in some cases.

LIBOR appears only in legacy floating-rate bridge loans or older agreements.

Qualification requirements:

Commercial banks may require higher credit scores than residential lenders. Businesses operating under a different name may need additional documentation to qualify.

Loan term and costs:

Terms can extend up to 30 years.

Swap rates directly impact your overall interest cost.

Pay attention to points and closing costs relative to prevailing swap/SOFR rates.

Advantages of commercial loans:

Lower default risk than consumer loans

Potentially lower interest costs (~15% savings in refinancing scenarios)

Scalability for long-term business growth

Commercial mortgage refinance is a process by which the interest rate on a commercial loan is reduced. Contact Us – 866-647-1650