The capitalization rate, or cap rate for short, is the great equalizer of real estate investment properties. IF you have correct property financials and underwrite appropriately, it is the ideal way to compare two completely different property types to determine profitability. There are, however, limitations to what the capitalization rate will tell you.

The Capitalization Rate WILL Measure Investment Risk

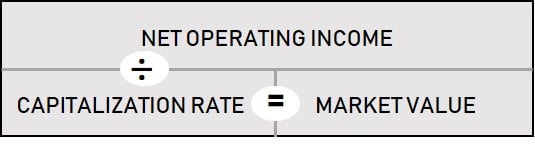

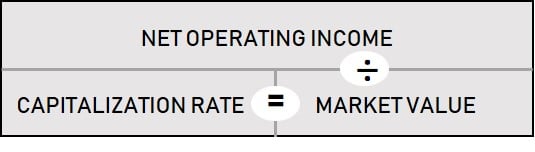

The cap rate is designed to measure the ratio between a property’s net operating income and its market value. It measures the return an investor will receive if the net income remains constant. The capitalization rate is determined by dividing the net operating income by the market value.

One of the unique qualities with the capitalization rate is to measure an investor’s risk. The higher the cap rate, the higher the perceived risk.

Let’s look at two different real estate investments. First, there is an older strip mall with a net operating income of $520,000 listed for $6,500,000. If you divide the NOI by the list price, it reveals a cap rate of .08 or 8 percent. There is also a newly constructed retail building on a long-term lease to Starbucks. It is also listed for $6.5 M with a NOI of only $292,500. It has a cap rate of 4.5 percent.

The strip mall is generating substantially more income, but the risk is much higher. Non-franchised tenants have higher turnover and are more often delinquent in paying the rent. Repairs are hard to predict and subject to change. Suffice it to say, a strip mall without a large anchor will require substantially more property management. The net lease building, on the other hand, is on an absolute net lease with no landlord responsibilities and a corporate rent guarantee. There is virtually no risk with this real estate investment. Hence the reason that the capitalization rate was considerably lower.

Which is the better real estate investment? It all depends on the risk tolerance of the investor. By determining the cap rate, an investor can better compare the risk between several listed commercial investments.

The Capitalization Rate WILL Determine Market Value

The local real estate market will set a cap rate for different investment types. Real estate agents and appraisers are good sources of this information as they have access to comparable sales data. A market-based cap rate can help an investor determine a purchase price.

Because we are seeking the purchase price (or market value), the formula is the net operating income divided by the capitalization rate.

Let’s go back to the strip mall. If the complex had a NOI of $520,000 but a list price of $7,500,000. The property’s cap rate would be 6.9 percent.

Is this a good real estate investment? It depends on the market data. Your broker shows you a market analysis that indicates the cap rate for similar properties is set at 8 percent. A rate of 6.9 percent would indicate that either (1) the property is in better condition, (2) the vacancy rate is lower, or (3) the property is over-priced. If the subject property is similar to the comparables, then the capitalization rate has indicated that the property is over-priced.

The Capitalization Rate WILL NOT Calculate an Investor’s Return

Here is the area where many investors fail to consider. The capitalization rate assumes a cash purchase. It does not factor in an investor’s debt service. Commercial mortgage payments are not included in a profit and loss statement and thus are not factored into the net income.

The actual return for the investor can be much different than indicated by the cap rate. Let’s return to the $6.5 M strip mall with a cap rate of 8 percent. The investor puts down 30% (or $1,950,000) and finances the rest at 4.75 percent interest with a 30-year amortization. The cash flow after the debt service is $235,180.

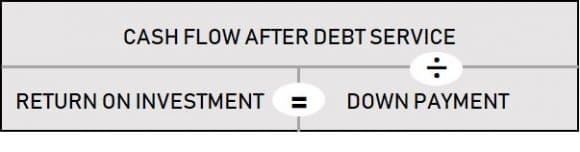

What is the Return on the Investor’s Income? We need to use the return on investment (ROI) formula to calculate the actual return on the out-of-pocket investment. Take the cash flow after debt service and divide it by the down payment.

In this case, the investor owns a property that is generating $235,180 annually and he personally paid $1,950,000 for it. His return on his money invested is 12.06 percent. His actual return is over 4 percent higher than indicated by the capitalization rate! If you would like an easy tool to calculate your ROI, use Clopton Capital’s commercial mortgage calculator.

The Capitalization Rate WILL NOT Tell You Everything

Cap rates are an easy way to size up a property on a quick glance, however a decision of whether to make an investment should not be made solely on them.

Consider an acquisition, where the cap rate is based off of historical information given to you by the sellers. What cap rates based on historical information will not take into account is future issues that may come up once you acquire the property. Are there deferred maintenance items that need to be addressed? is the property tax bill set to increase? Are there tenants that are planning to leave? All these and more are concerns that need to be explored when evaluating a property and all can play into the cap rate of the investment.

The take away. Before purchasing a real estate investment, compare both the capitalization rate for the subject property and the market. After the purchase, throw out the capitalization rate and use the return on investment formula to measure the success of your investment portfolio.