| Current | 1 Day Ago | 1 Month Ago | 1 Year Ago | |

|---|---|---|---|---|

| SOFR | ||||

| 1 Month Term | 5.3288% | 5.3287% | 5.3308% | 5.1964% |

| US Treasuries | ||||

| 5 Year | 4.120% | 4.122% | 4.235% | 3.935% |

| 7 Year | 4.135% | 4.138% | 4.227% | 3.856% |

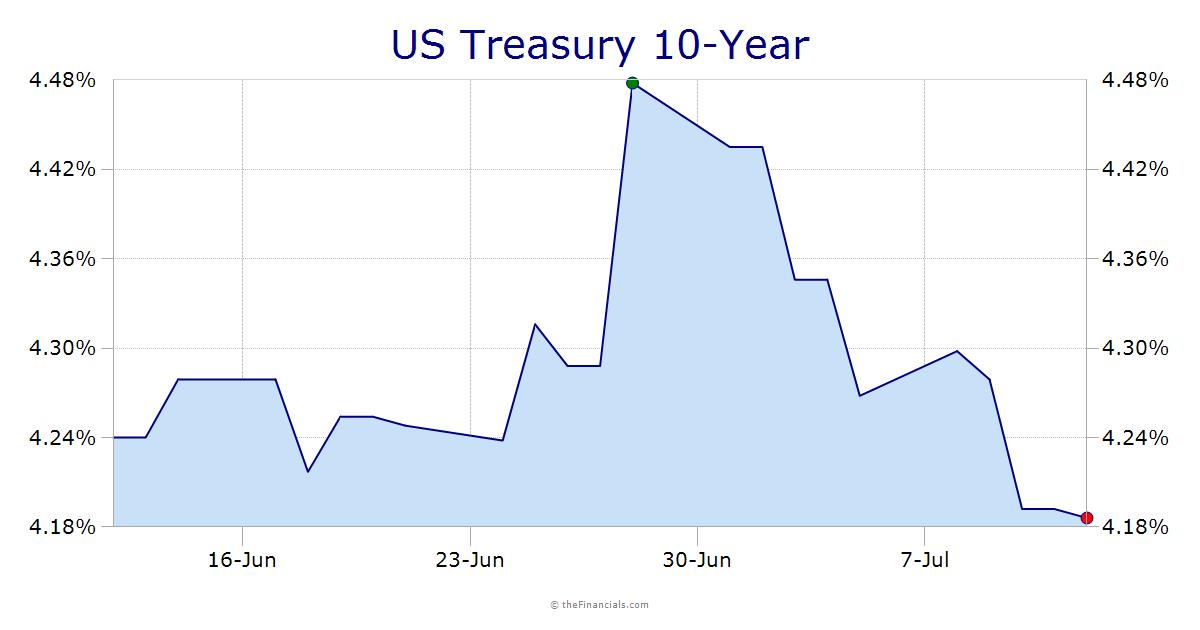

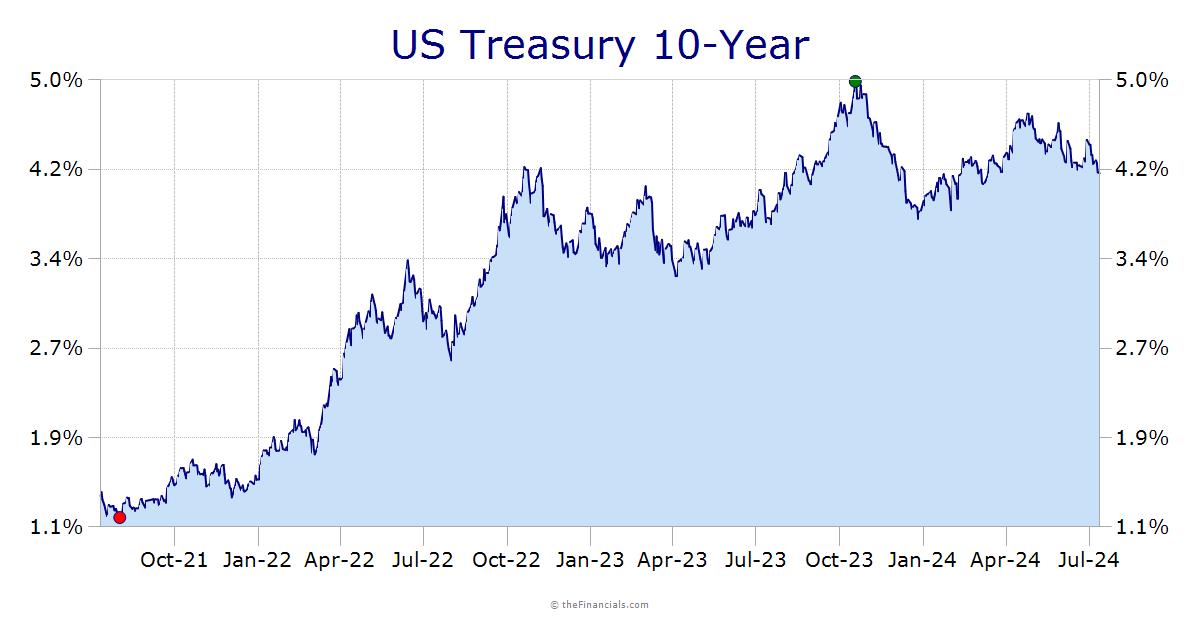

| 10 Year | 4.196% | 4.192% | 4.240% | 3.759% |

Here you can find current 5, 7, & 10 year swap rates, treasuries, and current Libor rates. These are the most common index rates used when pricing commercial real estate financing. When quoting a loan rate to you, a lender will most likely quote a “spread” over one of these index rates.

Below are a couple examples to illustrate how you would calculate a potential loans coupon, using spreads and swap rates, treasuries, or Libor.

These rates are the primary benchmark pricing index for the majority of commercial real estate loans. Products such as CMBS, Fannie Mae, Freddie Mac, life insurance loans, and many bank loans price their interest rates using 5, 7, or 10 year swap rates. Some lenders will price over treasuries rates, however swaps are used much more often. Libor rates are primarily used in floating rate loans and you will see them commonly in bridge financing. Typically 1 month Libor is used to price bridge loans.

It’s more difficult to qualify for commercial banks because banks usually require a higher credit score for a commercial loan. If your business has been operating under a different name, this can be tricky to prove.

The time it takes to complete the process of applying and qualifying can be long.

It’s also important to pay close attention to the “points” that accompany the loan as well as what you’ll owe in closing costs

The following are four types of commercial property refinance loans. This is not an exclusive list, and other options include CRE refinance options for small business loans such as an SBA 504 refinance loan not found here. Other options include secured business loans.

Commercial mortgage refinance is a process by which the interest rate on a commercial loan is reduced. Contact Us – 866-647-1650

Chicago based Clopton Capital is a national commercial mortgage broker dedicated to matching borrowers interested in multifamily, industrial, commercial, & mixed-use real estate to lenders aligned exactly with their needs for asset-backed funding.

Commercial Insurance Products are offered through Clopton Insurance Services, LLC.

Clopton Capital © 2026 / All Rights Reserved